Introduction:

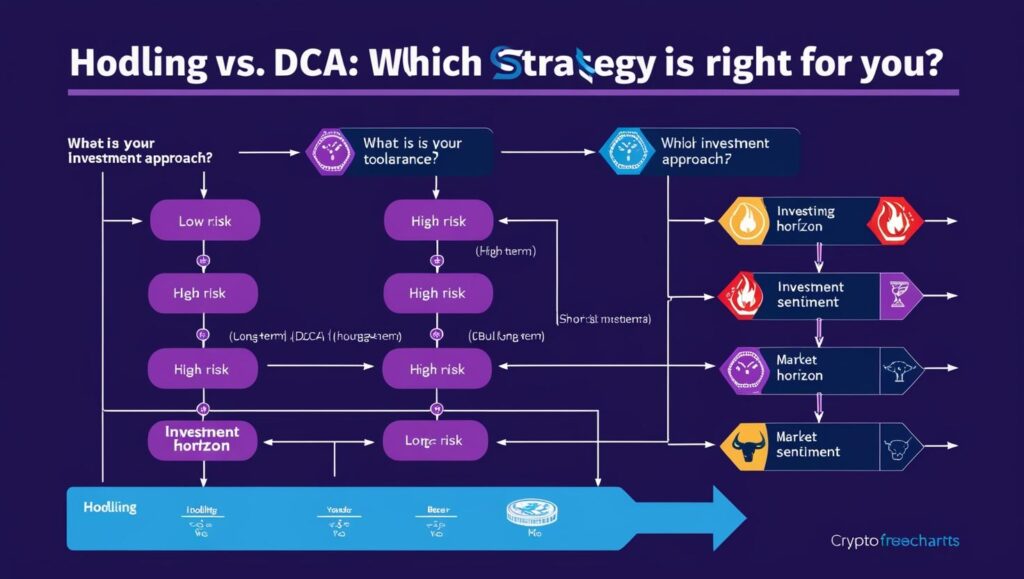

So we gonna talk about Hodling vs DCA in this article. With prices falling, uncertainty increasing, and market anxiety taking hold, investing in a bear market can be intimidating. When it comes to navigating downturns and positioning oneself for long-term gains, investors must decide between Dollar-Cost Averaging vs HODLing, two widely used approaches in crypto investing.

In this article, we explore the best crypto investment strategy by analyzing the pros, cons, and strategic impact of HODLing and DCA in bear markets. You can create a wonderful wealth creation strategy by comprehending these investing approaches and coordinating them with your financial objectives.

What is HODLing?

The Origin of HODL

The term HODL originated in a Bitcoin forum post in 2013 when a user mistakenly wrote “HODL” instead of “HOLD.” Since then, it has become a mantra in the blockchain technology and cryptocurrency space, representing a long-term investing strategy and a HODLing strategy in a bear market that helps investors navigate downturns.

Understanding the HODLing Strategy

HODLing is the practice of purchasing and holding assets for an extended period of time, regardless of market conditions, particularly volatile ones like Bitcoin. As a best crypto investment strategy, this approach is based on the belief that markets will recover over time, and patient investors will reap the benefits.

Strategic Plan Behind HODLing

HODLing aligns with Michael Porter’s Competitive Strategy, which emphasizes maintaining a competitive advantage by focusing on long-term market trends instead of reacting to short-term price movements. However, investors also consider the DCA strategy for cryptocurrency as an alternative to mitigate risks while steadily building their portfolios.

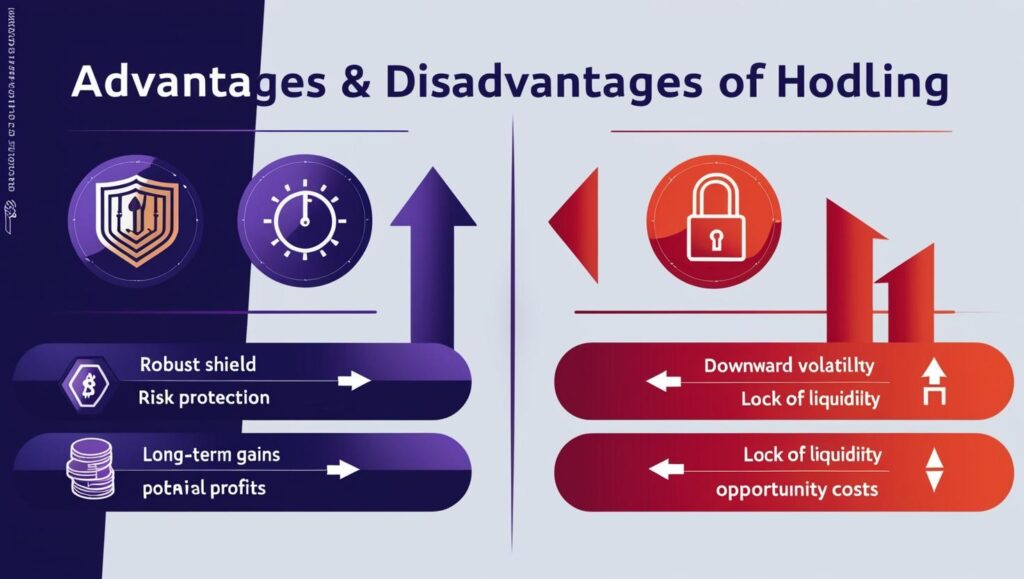

Advantages of HODLing

✔ Avoids Emotional Decision-Making – Investors don’t panic-sell during downturns.

✔ Lower Transaction Fees – Costs are decreased when there are fewer deals.

✔ Potential for High Long-Term Gains – Early adopters stand to gain a significant deal if assets increase in value.

Disadvantages of HODLing

❌ High Volatility Risk – Holding through bear markets can result in large unrealized losses.

❌ No Short-Term Gains – Price changes don’t generate profits for investors.

❌ Opportunity Cost – HODLers might miss better entry points or alternative investments.

What is Dollar-Cost Averaging (DCA)?

Understanding DCA

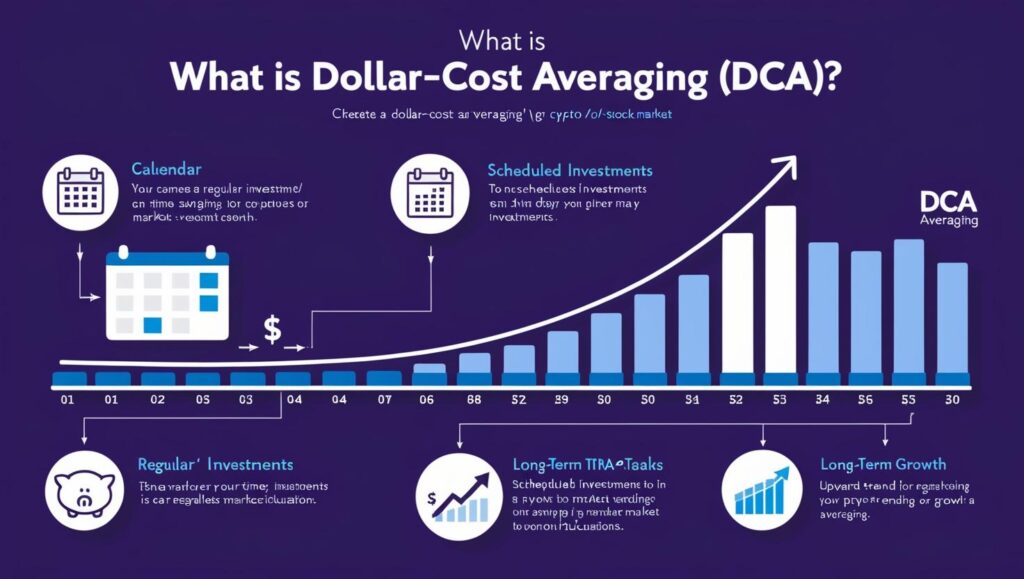

When comparing HODL vs DCA, one of the most popular investment strategies is Dollar-Cost Averaging (DCA). DCA is an investing method where an investor buys a preset dollar amount of an asset at regular intervals, regardless of market price. This approach decreases risk by averaging the purchase price over time, making it a best crypto investment strategy for those looking to mitigate volatility.

The Strategic Plan of DCA

In the debate of dollar-cost averaging vs HODLing, DCA operates as a cohesive collection of options that reduces the effect of transient price swings. Unlike the HODLing strategy in a bear market, which requires patience through market downturns, the DCA strategy for cryptocurrency spreads investments over time, preventing emotional investing and ensuring consistent asset accumulation.

Advantages of DCA

✔ Reduces Risk in a Bear Market – By spreading out investments throughout time, market crashes are avoided.

✔ Eliminates the Need for Market Timing – It is not necessary for investors to foresee the bottom.

✔ Encourages Discipline – An organised strategy for long-term investment.

Disadvantages of DCA

❌ May Not Maximize Returns in a Bull Market – Investors may miss out on purchasing in bulk at discounted rates.

❌ Requires Patience and Commitment – Results take time to materialize.

❌ Transaction Fees Can Add Up – Regular purchases result in minor expenses that mount up over time.

Comparing HODLing vs. DCA in a Bear Market

| Component | HODLing | DCA |

| Risk Level | High due to market swings | Lower due to averaging effect |

| Market Timing | No need to time the market | No need to time the market |

| Volatility | High | Lower impact |

| Best For | Long-term believers in assets | Risk-averse, patient investors |

In a bear market, which approach is more effective?

- HODLing works best for those who believe in the long-term value of their assets and can endure price fluctuations.

- DCA is ideal for risk-averse investors who prefer steady investments without worrying about market timing.

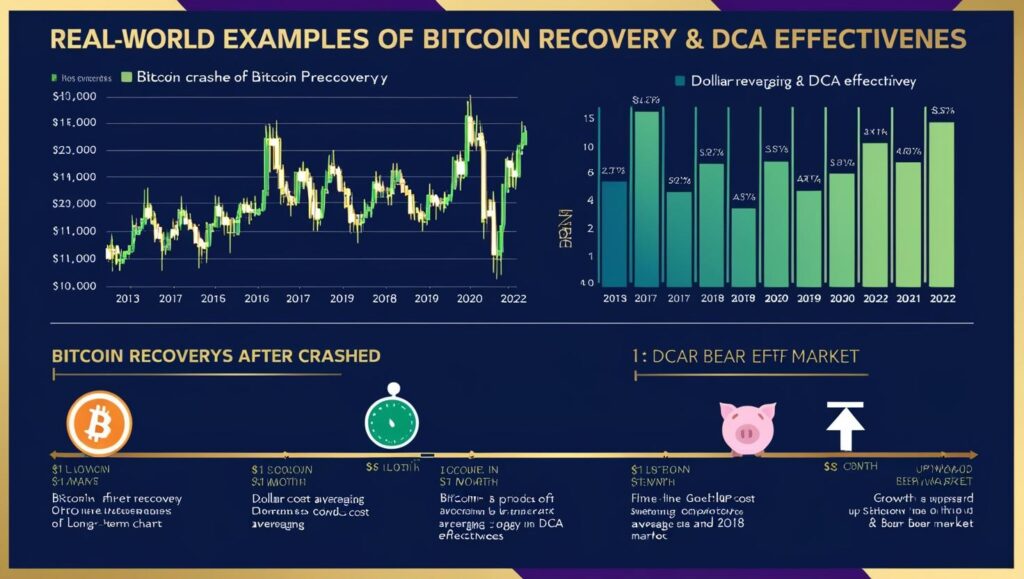

Real-World Examples

- Bitcoin HODLers who held through previous bear markets saw massive gains when prices rebounded.

- Investors using DCA during the 2008 financial crisis accumulated stocks at lower prices and benefited later.

Expert Insights & Strategic Planning

Michael Porter’s Competitive Strategy in Investing

Applying Michael Porter’s Competitive Strategy, investors concentrate on assets that provide sustained competitive advantages. Keeping up with market developments and strategic planning is essential whether employing DCA or HODLing.

Lessons from Past Bear Markets

Playing to Win: Investors who remained disciplined, regardless of their strategy, saw the best returns.

The Role of Blockchain Technology: Crypto markets are known for volatility, but long-term adoption trends indicate strong potential for growth.

Conclusion: Which Strategy Should You Choose?

Both HODLing and DCA are valid strategies, but the best choice depends on your financial objectives, risk tolerance, and market forecast.

- HODLing suits those who believe in the long-term price of Bitcoin and blockchain technology.

- DCA is a great strategy for those looking to mitigate risks while steadily accumulating assets.

Whichever approach you decide on, making wise decisions and maintaining discipline are essential to long-term success in a bear market.