Introduction

Investing in cryptocurrency is a thrilling but uncertain financial venture. Many investors experience emotional turmoil due to Extreme market volatility causes leading to impulsive decisions which results in rash actions driven by fear and greed. This emotional rollercoaster often results in financial losses and stress.

Dollar-Cost Averaging (DCA) in Crypto is one of the best ways to overcome these obstacles. In crypto investing strategy DCA is a systematic investment approach that involves consistently investing a fixed amount of money into cryptocurrencies at regular intervals, regardless of price fluctuations. This article explores the psychological benefits of DCA in crypto investing strategy, emphasizing how it helps reduce stress, manage emotions, and cultivate a disciplined investment mindset.

Understanding Dollar-Cost Averaging (DCA) in Crypto

What is DCA?

DCA is a well-known investment strategy where investors buy assets at regular intervals rather than making a lump sum investment. This method is particularly useful in the volatile crypto market, where prices fluctuate drastically.

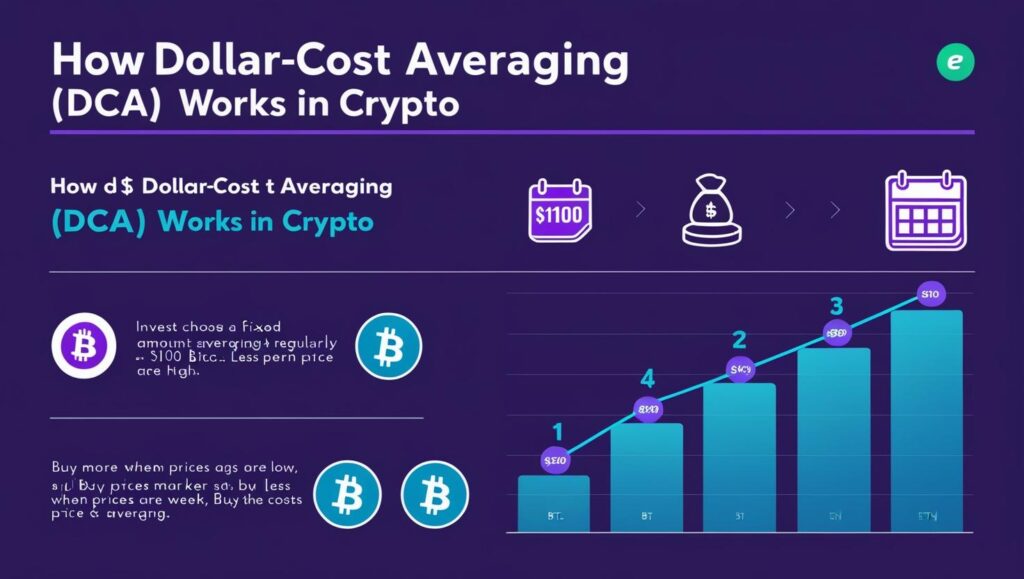

How Does DCA Operate?

- An investor selects a certain cryptocurrency, such as Ethereum or Bitcoin.

- They set aside a fixed amount of money such as $134 every week to invest.

- They keep making continuous investments regardless of market conditions they continue investing consistently.

- Over time, the investor acquires more assets when prices are low and fewer when prices are high, averaging the purchase cost.

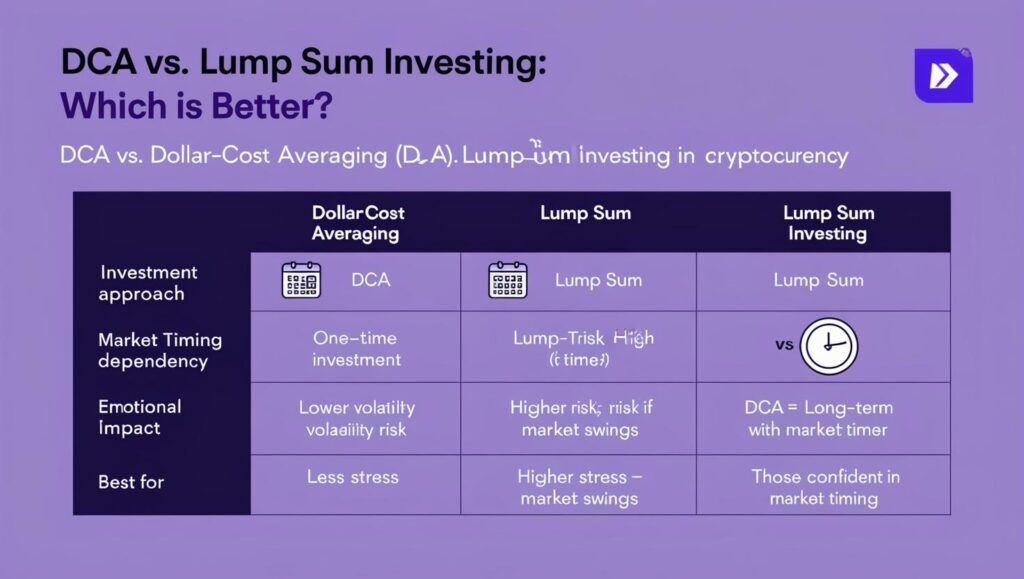

DCA Investing vs. Lump Sum

DCA

Reduces the emotional burden of trying to time the market and smooths out price fluctuations.

Lump Sum Investing

Requires exact market timing, which may be extremely dangerous and unpleasant, particularly in uncertain cryptocurrency markets.

The Psychological Challenges of Cryptocurrency Investing

Crypto markets are infamous for their extreme volatility. This lack of clarity leads to psychological problems, such as:

Market Volatility and Emotional Investing

Many investors struggle with panic buying during bull markets and panic selling during bear markets. this market volatility and emotional investing leads to financial losses.

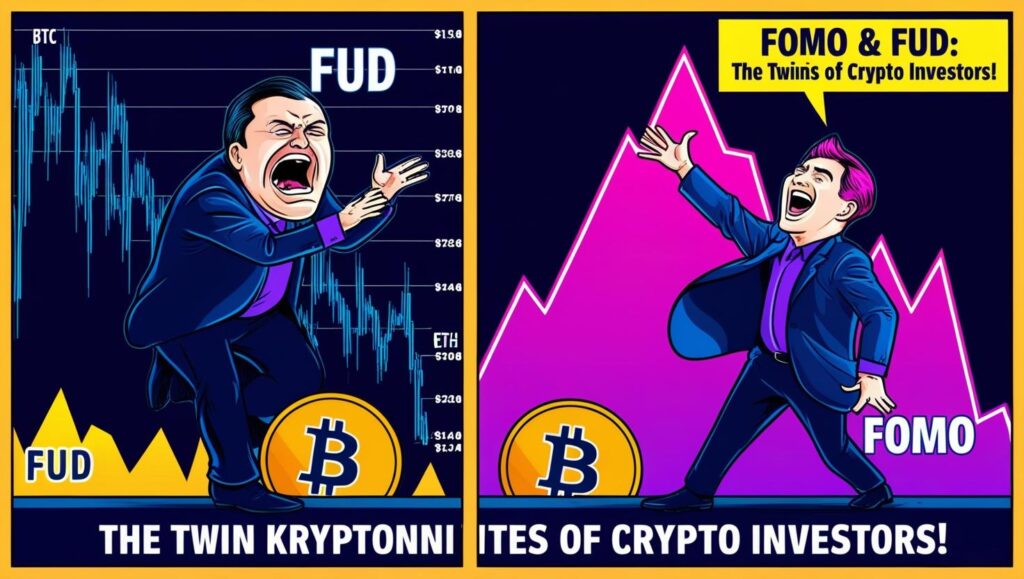

FUD (fear, uncertainty, doubt) and FOMO (fear of missing out)

FUD

Negative news or social media speculation leads to panic-selling, Even when the fundamentals are still solid.

FOMO

investors scramble to purchase assets during price surges, fearing they may lose out on Profits.

The significance of Market Timing

It is almost impossible to predict market tops and bottoms. Investors often make mistakes by buying at peaks and selling at lows, which causes tension and dissatisfaction.

How Dollar-Cost Averaging Reduces Crypto Investing Stress

Removes the Need for Market Timing

DCA removes The stress of choosing the “right time” to invest, making it easier to stay consistent free from emotional disruption.

Builds Self-Belief and Self-Control

Regular investment helps people develop a disciplined mindset, preventing rash decisions based on short-term price movements.

Research and Real-World Examples

Studies have shown that long-term crypto investment help those investors who employ DCA frequently achieve better returns than those who try to play the market in terms of returns. Many successful crypto investors attribute their financial achievements to a DCA strategy.

The Reasons DCA Is the Greatest Long-Term Crypto Investment Strategy for Emotional Investors

Stops Impulsive Trading Behaviors

DCA discourages speculative trading and emotional decision-making, DCA lowers the possibility of expensive investment errors.

Encourages a Long-Term Investing Attitude

Investors learn to be patient and let their assets increase in value over time instead of focusing on short-term gains.

Success Stories of DCA Investors

Many investors who started using DCA during Bitcoin’s early days have seen significant long-term growth, proving the effectiveness of this strategy and more than that its stress-free crypto investing strategy.

Additional Benefits of DCA in Crypto

Reduced Risk Exposure

Investing gradually reduces the impact of short-term price fluctuations, lowering overall investment risk.

More Reasonably Priced for Small Investors

DCA allows individuals with limited capital to enter the crypto market without needing large initial investments.

Better Sleep at Night

Investors may stay composed and confident in their approach since DCA removes the anxiety associated with market timing.

Best Practices for Implementing a DCA Crypto Strategy

Select a Trustworthy Exchange

Choose platforms like Binance, Coinbase, or Kraken that facilitate automated DCA.

Select Strong Fundamental Cryptocurrencies

Instead of investing in high-risk altcoins, Focus on well-established assets like Bitcoin (BTC) and Ethereum (ETH).

Stay Consistent

Regardless of market conditions, Stick to your investment schedule, whether it is weekly, biweekly, or bimonthly, monthly.

Review but don’t freak out

Keep a close eye on your portfolio but avoid reacting to short-term price swings emotionally.

Conclusion

There is no denying DCA’s psychological advantages when it comes to cryptocurrency investing. By removing the stress of market timing, reducing emotional decision-making, and encouraging a long-term approach, DCA helps investors build wealth steadily and confidently.

Consider implementing a DCA crypto approach right now if you want to reduce stress and increase your chances of success in the cryptocurrency space. In crypto, have you tried DCA? Leave a comment with your experience!