Crypto Mining

An Honest Look Into the Engine Behind Digital Currency

Imagine a world where money isn’t printed by governments but earned by solving puzzles. Welcome to the realm of crypto mining — a digital hustle that powers cryptocurrencies like Bitcoin.

If you’ve heard the term but never quite got what it means (or if you’re thinking of diving in), this blog will unpack crypto mining in plain English — no hype, no fluff.

🚀 Mining Crypto? Sounds Weird. What Does It Actually Mean?

Despite the name, crypto mining has nothing to do with pickaxes or digging underground. It’s more like a giant global math competition that computers participate in.

In essence:

Crypto mining is the process of verifying transactions on a blockchain network using computing power. As a reward, miners earn cryptocurrency in return for their computational work — essentially getting paid in digital coins for keeping the network secure and running.

Still fuzzy? Let’s break that down 👇

🧠 The Simple Logic Behind Crypto Mining

Every time someone sends cryptocurrency (like Bitcoin), that transaction needs to be verified — otherwise, someone could fake it or double-spend it.

Since there’s no central bank, this job is handled by miners — people (or companies) who use computers to validate these transactions.

Here’s how it works:

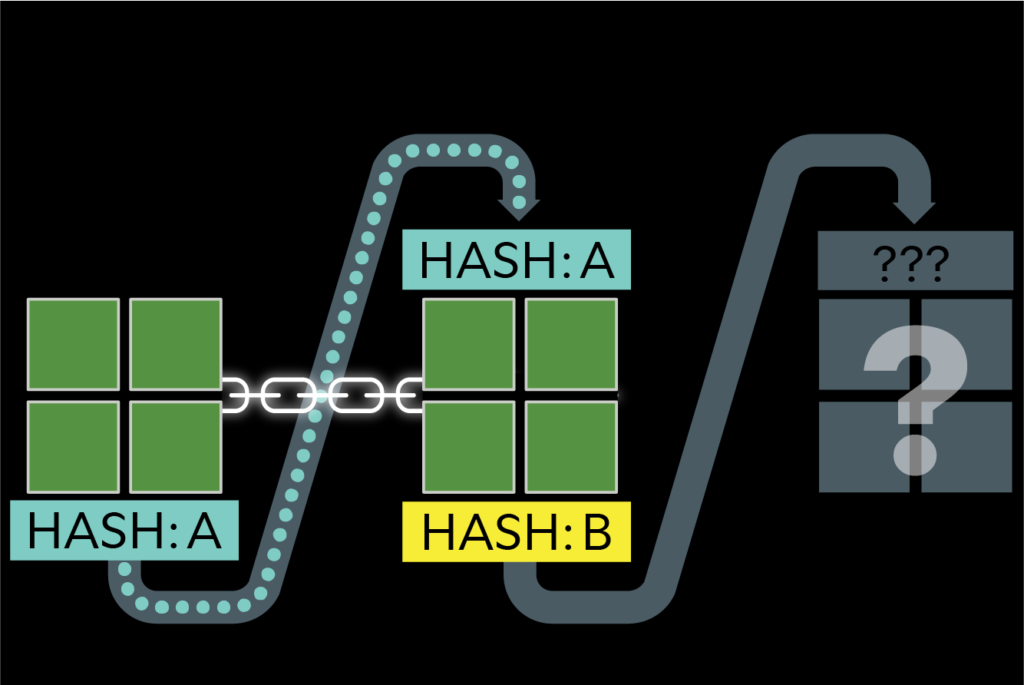

- A batch of crypto transactions (called a block) gets broadcast to the network.

- Miners compete to solve a cryptographic puzzle that secures that block.

- The first miner to solve it broadcasts the answer to others.

- Once the solution checks out and the network reaches consensus, the block becomes a permanent part of the blockchain’s history.

- The winning miner gets rewarded with cryptocurrency.

🎯 The process is called Proof of Work (PoW) — and it’s how Bitcoin and many other coins keep their networks trustworthy.

🔗 Proof of Work explained by Ethereum

🛠️ What You Actually Need to Mine Crypto

Crypto mining isn’t just for computer geniuses anymore, but it does take gear, patience, and power. Here’s what’s essential:

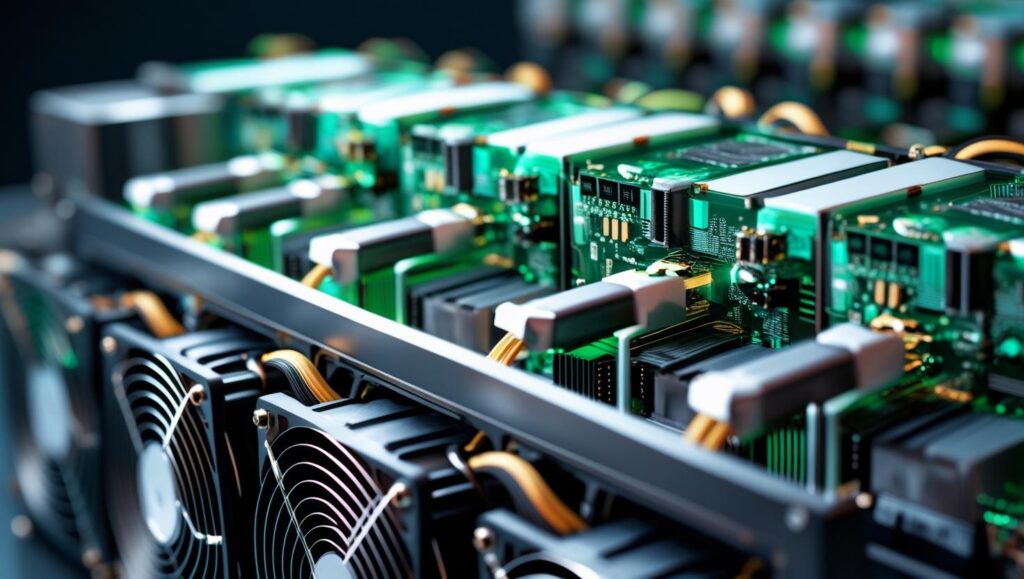

💽 Hardware

- ASIC miners: Designed specifically to mine Bitcoin, extremely fast and power-hungry.

- GPU rigs: Built with multiple graphics cards; great for mining coins like Ravencoin or Kaspa.

🛠️ Best mining hardware in 2025 – TechRadar

🧑💻 Software

Tools to help your rig talk to the blockchain:

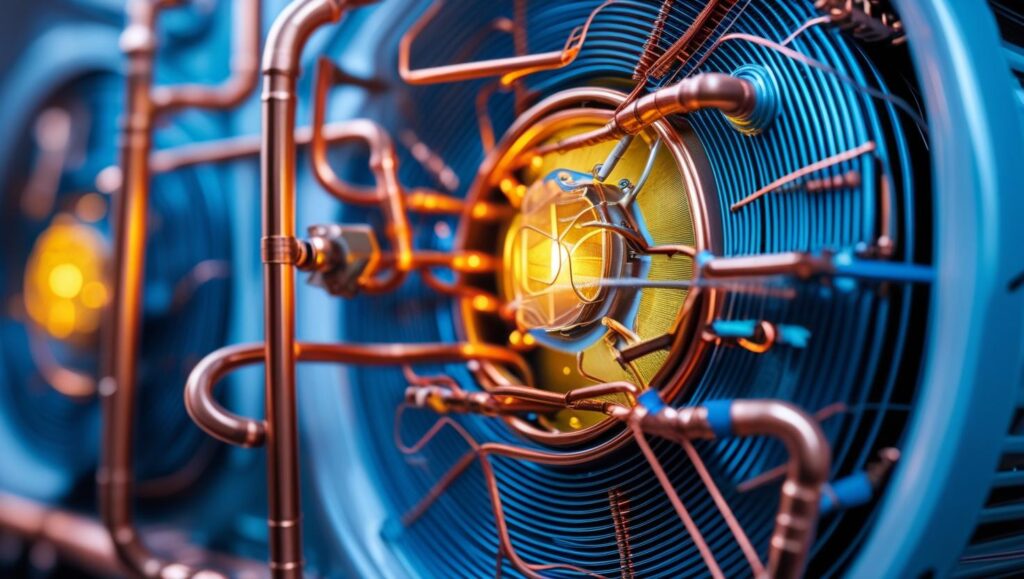

🔌 Electricity & Cooling

Mining rigs are heat monsters. You’ll need:

- Reliable electricity (cheap rates are a game-changer)

- Proper ventilation or even industrial cooling fans

🔐 Wallet

You’ll need a crypto wallet to store your earnings securely. Hardware wallets like Ledger or Trezor are your safest bets.

💸 Is Mining Still Profitable in 2025?

Let’s be brutally honest: crypto mining isn’t as easy or as cheap as it was five years ago. But it can still be profitable under the right conditions.

Here’s what impacts mining profit:

- Electricity costs (this is your biggest enemy)

- Coin price (higher BTC/ETH = higher rewards)

- Mining difficulty (the more people mining, the tougher the competition — and the smaller each miner’s reward)

- Hardware efficiency

📈 Use this mining calculator – CryptoCompare

Pro tip: Most miners now join mining pools to share processing power and split the rewards more evenly.

🤝 Top mining pools this year – Cointelegraph

🌱 What About the Environmental Backlash?

Crypto mining has faced heavy criticism for the massive amount of electricity it consumes to keep networks running around the clock.

Some stats have compared Bitcoin’s annual energy use to that of small countries.

Here’s why:

- Solving those blockchain puzzles eats up tons of electricity.

- Most rigs run 24/7.

- Not every miner uses green energy.

⚡ Cambridge Bitcoin Electricity Consumption Index

BUT — the space is evolving.

- Ethereum switched to Proof of Stake (no mining needed).

- Newer blockchains are eco-friendly by design.

- Miners in places like Iceland are going solar and hydro.

🌍 Ethereum’s shift to PoS – Ethereum Foundation

🔮 What Does the Future of Mining Look Like?

Crypto mining is at a crossroads. Here’s what’s changing:

| Trend | Meaning |

| 💡 Proof of Stake | Less mining, more coin staking |

| 🌿 Green Mining | Solar, wind & hydro power rigs |

| 🏭 Mining Consolidation | Big farms dominating the game |

| 📜 Legal Regulations | Taxation and energy limits globally |

| 💻 AI-optimized mining | Smart rigs that auto-adjust power usage |

📚 Crypto mining regulations worldwide – WEF

🎯 Final Verdict: Should You Try Crypto Mining?

Mining isn’t dead — but it’s not for the faint of heart either.

✅ Yes, if:

- You have cheap electricity

- You’re tech-savvy

- You’re okay with upfront investment

❌ No, if:

- You’re looking for “easy money”

- You live where energy is expensive

- You aren’t ready to maintain hardware

Instead, you might explore cloud mining, staking, or investing directly in crypto.

🤔 Still Curious?

Crypto mining is the backbone of blockchain trust, but it’s not as simple as “plug in and get rich.” It takes planning, patience, and power. If you’re in it for the long haul, it can pay off.

Have questions? Thinking about setting up a mining rig or joining a pool?

👇 Drop your thoughts or queries in the comments — I respond to every single one.