Introduction

Cryptocurrency has evolved from a fringe technological concept into a powerful force reshaping the global financial landscape. But with soaring prices, viral coins, and massive hype, a crucial question lingers: Are we in a cryptocurrency bubble? In this blog, we explore what a financial bubble is, whether crypto fits that mold, and what investors need to watch out for.

🔍 What is a Financial Bubble?

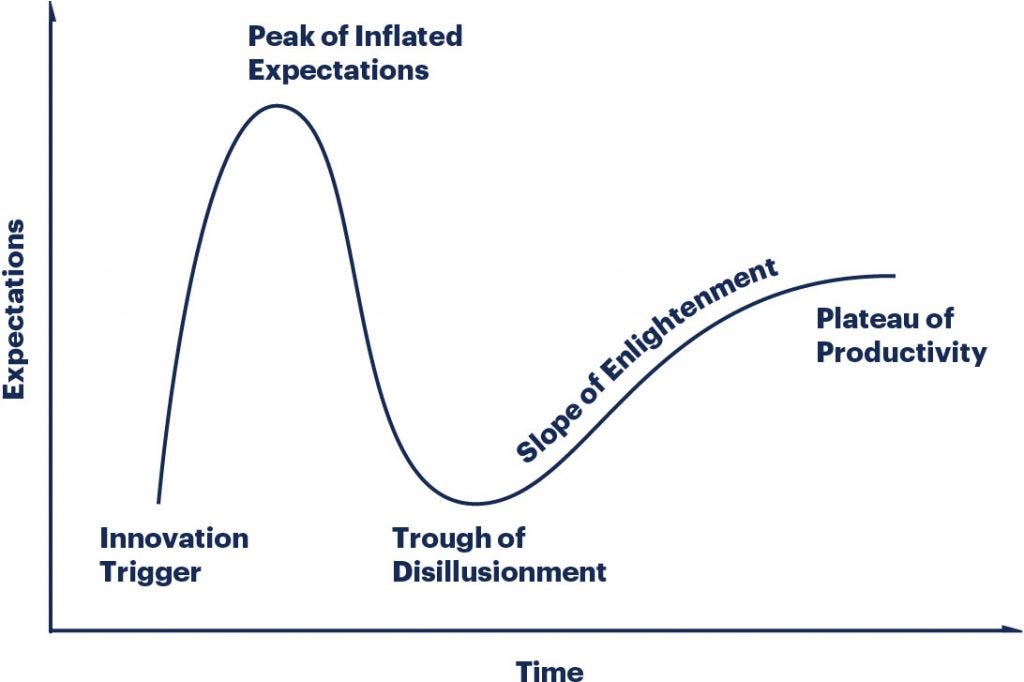

A financial bubble forms when an asset’s price soars well above its actual worth, driven more by emotion and speculation than by underlying fundamentals

The typical bubble pattern:

- Hype & Speculation

- Rapid Price Surge

- Mass Adoption

- Peak Euphoria

- Crash

Historic examples include the Dot-Com Bubble and the 2008 Housing Crisis.

🚀 The Rise of Crypto: Innovation or Hype?

Between 2017 and 2021, cryptocurrencies like Bitcoin and Ethereum experienced massive growth. But was this purely innovation, or a speculative frenzy?

- Billions Raised via ICOs

- NFTs Selling for Millions

- Tokens with No Utility Going Parabolic

Many tokens with zero product or purpose reached billion-dollar valuations. The line between investment and speculation got blurry.

⚠️ 4 Warning Signs of a Crypto Bubble

- Sky-High Valuations Without Utility

A coin with no real use shouldn’t be worth billions. But many were. - Speculative Behavior

Most investors bought not because they believed in the project, but because they hoped to sell to someone else at a higher price. - Social & Celebrity Hype

When memes, influencers, and celebrities dominate investment decisions, it’s a red flag. - Volatility & Pump-Dump Cycles

Rapid price movements often stemmed from coordinated pumps, not genuine demand.

💥 Has the Crypto Bubble Burst?

Crypto has experienced multiple crashes:

- 2018 Post-ICO Crash

- 2022 Terra-Luna Collapse

- FTX & Centralized Exchange Failures

Yet, the industry continues to evolve. Many believe the “bubble” phases are cleansing cycles, removing weak projects while stronger ones gain legitimacy.

🔐 Blockchain: The Real Innovation Behind the Hype

Even if some tokens are overhyped, the blockchain technology powering them is undeniably valuable:

- Decentralized Finance (DeFi)

- Smart Contracts

- Cross-Border Payments

- Supply Chain Transparency

The next wave may be more about utility and adoption than speculation.

🧠 What Can Crypto Investors Learn?

✅ Do Your Own Research (DYOR)

Avoid investing based on hype or influencers. Understand the tech, team, and roadmap.

✅ Be Cautious With Meme Coins

They can spike fast, but they can also crash faster.

✅ Focus on Long-Term Value

Invest in real utility, not promises.

✅ Watch for Regulation

Clear global regulations could bring structure to the crypto market, reduce fraud, and offer greater protection for investors.

📈 Final Thoughts: Bubble or Breakthrough?

Yes, cryptocurrency may be experiencing bubble-like behavior. But bubbles don’t always mean the end—they often precede meaningful innovation. Just like the Dot-Com bust gave rise to Google and Amazon, the crypto shakeouts may pave the way for more resilient, impactful projects.

More From Us

Cryptocurrency Investment Strategies

The Psychological Benefits of Dollar