Introduction

Investing in cryptocurrency can be uncertain because of market volatility. One Crypto investment strategies that helps reduce risk is Dollar-Cost Averaging (DCA) or Automated DCA, where investors buy small amounts of crypto at regular intervals instead of making a single large purchase. DCA helps investors maintain consistency by reducing the impact of price swings.

By automating this process, time is saved, disciplined investing is ensured, and emotional decision-making is eliminated. In this guide, we will examine the best Cryptocurrency investment platforms to automate DCA.

What is Dollar-Cost Averaging in crypto?

Dollar-Cost Averaging in crypto is an investment technique where you purchase a fixed dollar amount of an asset at regular periods, regardless of price.

In contrast to investing in lump sums:

- DCA Advantage: Reduces risk by spreading purchases over time, lowers risk, and helps prevent poor market timing.

- Lump Sum Investing Advantage: Can optimise profits if the market rises right after the investment.

DCA is particularly useful in the crypto market, where prices can fluctuate significantly within short periods. By automating DCA, investors remove the temptation to time the market and gradually increase their wealth by automating DCA.

Why Automate DCA? (Benefits)

- Eliminates Emotional Bias: No more panic buying or selling due to market fluctuations.

- Time-saving: Set it and forget it—There’s no need to buy cryptocurrency by hand.

- Enhances Discipline: Invest consistently without second-guessing.

- Potential Cost Savings: When compared to manual purchases, many automated DCA platforms offer low transaction fees.

Best Automated DCA Tools & Platforms

A. Cryptocurrency Exchanges with Integrated DCA

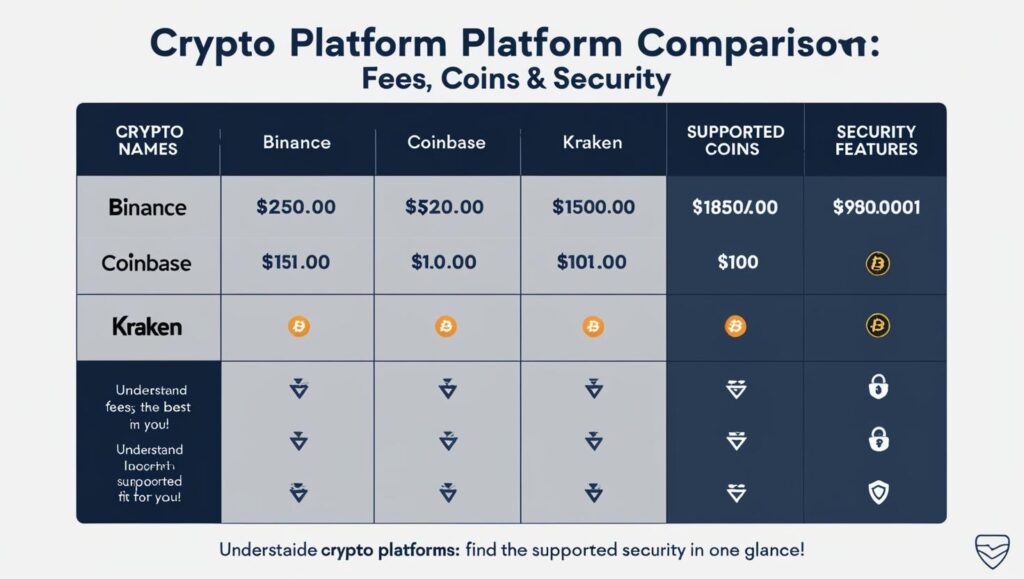

Binance Auto-Invest

- Supports multiple cryptocurrencies, and variable scheduling is possible.

- Minimal costs and suitable for beginners.

- Pricing: Standard Binance trading fees apply.

Coinbase Repeat Purchases

- Simple to use and ideal for US-based investors.

- Higher fees compared to other platforms.

- Pricing for bank account purchases is 1.49% per transaction.

Kraken DCA Feature

- Lower fees and high liquidity.

- Better suited for advanced investors.

- Pricing: The starting trading fee is 0.16%.

B. Apps & Third-Party Automated Crypto Trading bots

CryptoHopper

- AI-powered DCA strategies.

- Advanced automation features.

- Pricing: Paid subscriptions start at $19 per month. Free trial also available.

3Commas

- Connects to several exchanges.

- User-friendly with customisable DCA bots.

- Pricing: starting price is $22 per month.

Shrimpy

- Rebalancing the portfolio with DCA automation.

- Works with significant exchanges.

- Pricing: The starting price is $15 per month.

C. DeFi & Non-Custodial DCA Tools

Balancer Smart Pools

- Enables DCA without a centralised exchange.

- Perfect for DeFi investors.

- Pricing: Transaction fees vary depending on the network.

Mean Finance (Ethereum)

- Permitted on-chain DCA with smart contracts.

- Excellent for decentralised investors.

- Pricing: Gas fees apply.

How to Choose the Right DCA Platform for You?

Fees: Examine the expenses of transaction and subscription costs.

Supported Coins: Verify if the platform accepts your preferred cryptocurrencies.

Security & Custody: Think about centralised vs. decentralised solutions.

Ease of Use: Certain platforms are more beginner-friendly than others.

Step-by-Step Guide to Setting Up Automated DCA

Example: Setting Up DCA on Binance

- Choose your crypto (BTC, ETH, etc.).

- Establish a Schedule for your investing (daily, weekly, or monthly investments).

- Decide how much you want to invest (e.g., $50 per week).

- Turn on automation and monitor results.

Typical Mistakes to Avoid

- Ignoring Fees: Always check for hidden charges.

- Overcomplicating Strategy: Maintain consistency and simplicity.

- Ignoring Performance: Modify your approach based on market conditions.

Conclusion & Final Thoughts

Automating DCA is a powerful way to invest in crypto with less stress and more discipline. Whether you choose a crypto exchange, a third-party Automated crypto trading bots, or a DeFi tool, the most important thing is to be constant and keep an eye on performance. Which one is What is your preferred DCA tool? Let us know in the comments!

2 thoughts on “Automated DCA: Best Tools and Platforms for Crypto Investors”