Dollar Cost Average !

Navigating the volatile world of cryptocurrencies can feel overwhelming, but the Dollar Cost Averaging (DCA) strategy provides a steady, reliable way to grow your crypto portfolio over time. As an automatic investment strategy, DCA minimizes the impact of market fluctuations, making it a practical and stress-free approach for investors. In this article, we’ll explore the benefits of Dollar Cost Averaging, how it works, and how you can use it to invest in cryptocurrencies in 2025.

Dollar Cost Averaging (DCA) is an investment strategy where you consistently invest a fixed amount of money at regular intervals, regardless of market conditions. This approach ensures a disciplined, long-term method of growing your portfolio while reducing the risks associated with market volatility.

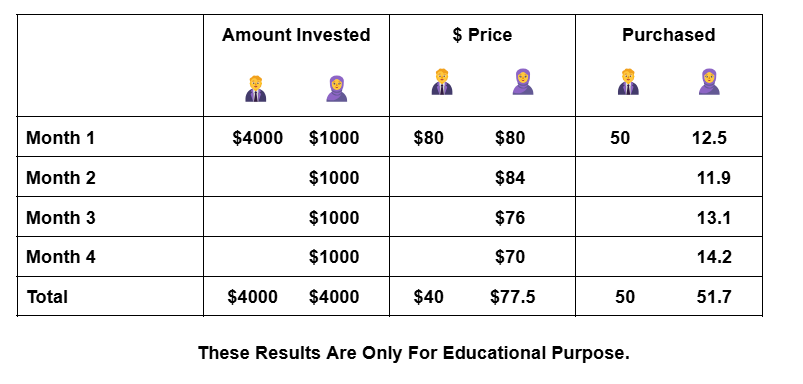

For Example:

if you invest $500 monthly into Bitcoin, you’ll buy more when prices are low and less when prices are high. Over time, this smoothens out the average cost per unit, reducing the impact of market volatility on your investment.

Let’s consider a simple example How Does A Dollar Cost Average Look in Graph.

How Does DCA Work in Crypto?

To understand the Dollar Cost Averaging strategy as an investment strategy in crypto, imagine using an automatic investment approach by allocating $100 to Bitcoin on the 1st of every month. When prices drop, you buy more Bitcoin; when prices rise, you buy less. Over time, this method balances your average cost per Bitcoin, showcasing the benefits of Dollar Cost Averaging by protecting you from market extremes.

After four months, you’ve invested $2,000 and accumulated 0.0517 BTC. The average price per Bitcoin becomes lower than the initial $40,000—demonstrating the effectiveness of Dollar Cost Averaging.

Benefits of DCA!!

1. Risk Mitigation:

Dollar Cost Average reduces the risk of investing a large sum during unfavorable market conditions.

2. Simplicity:

By Crypto Portfolio Managementther is no need to time the market—you invest consistently.

3. Effective in Volatile Markets:

Ideal for unpredictable assets like cryptocurrencies.

Step to start Dollar Cost Averaging

Step 1: Choose a Reliable Platform

Platforms like Binance, Coinbase, and Kraken offer automated DCA features. Ensure the platform has a good reputation and low fees.

Step 2: Select Your Cryptocurrencies

Focus on Crypto Investment Strategies and invest on strong assets like Bitcoin, Ethereum, or stablecoins. Diversification can also mitigate risks.

Step 3 : Set Your Budget

Choose a consistent schedule—weekly, bi-weekly, or monthly—based on your financial goals. Decide how much you can consistently invest (e.g., $50 or $100 per week/month).

Step 4: Automate Your Investments

Set up Automated Crypto Investing means automatic transfers to ensure consistency and eliminate the risk of missing a scheduled investment.

Visualizing DCA Performance:

Charts or graphs comparing DCA versus lump-sum investing highlight how this method smoothens the effects of market volatility.

Benefits of Dollar Cost Averaging in Crypto

Reduces Emotional Trading: Prevents panic buying or selling based on market swings.

Mitigates Market Volatility: Ensures a balanced cost over time.

Builds Investment Discipline: Encourages consistent, long-term investing habits.

Is Dollar Cost Averaging Suitable for Everyone?

DCA may not suit short-term traders or those aiming for quick profits.

DCA is ideal for:

Long-term Investors: Those seeking steady portfolio growth over years.

Beginners: Newcomers who lack the expertise to time the market.

Top Cryptocurrencies to Use for DCA in 2025:

1. Bitcoin (BTC)

As the most established cryptocurrency, Bitcoin remains a safe choice for DCA. But always do Cryptocurrency Market Analysis before invest.

2. Ethereum (ETH)

Ethereum’s growing utility in decentralized finance (DeFi) makes it a strong contender.

3. Promising Altcoins

Search for the Best Cryptocurrency to Invest in 2025 Consider altcoins with strong fundamentals, such as Solana (SOL) or Cardano (ADA). Always conduct thorough research.

Risks and Challenges of DCA in Crypto

Platform Fees: High transaction fees can eat into profits. Compare platforms before choosing.

Market Downturns: Prolonged bear markets may test investor patience.

Token Volatility: Prices can fluctuate wildly, impacting short-term returns.

Discipline: Skipping scheduled investments can disrupt the strategy.

Tips to Mitigate Risks

- Automate investments to maintain discipline.

- Use low-fee exchanges.

- Diversify your portfolio to spread risk.

- Stick to well-researched cryptocurrencies.

- Maintain a long-term perspective.

- Periodically review and adjust your strategy based on market conditions.

Conclusion

Start Your DCA Journey Today

A low-risk, approachable method for navigating the volatile bitcoin market is dollar cost averaging. It is a tried-and-true method of investing that reduces risk, streamlines decision-making, and increases wealth over time. You may create a strong portfolio without worrying about market timing by making regular investments over time.DCA can assist you in confidently navigating the erratic cryptocurrency market, regardless of your level of experience.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

We also write an article about DCA… Here’s the link (https://cryptonicnetworks.com/how-to-do-dollar-cost-average/) you can check it out and feel free to ask anything. Thanks!